6 2: Compare and Contrast Perpetual versus Periodic Inventory Systems Business LibreTexts

The results dictate the optimal amount of inventory to buy or make to minimise expenses. Sales Discounts, Sales Returns and Allowances, and Cost of GoodsSold will close with the temporary debit balance accounts to IncomeSummary. A company sells a product for $100, and the cost to produce the product is $60. If you’re in the market for a perpetual inventory help to obtain current tax year information individual system, make a list of all the features you might need before you start shopping around. This will help you avoid the distraction of fancy features that seem appealing but offer no direct value to your specific business model. Perpetual inventory software refers to an automated system designed for tracking and managing a company’s inventory.

Sale Transactions

- These analyses are more complex in periodic systems since the system accumulates data at a high level.

- The return of goods from customers to seller also involves two journal entries – one to record the sales returns and allowances and one to reverse the transfer of cost from inventory to COGS account.

- By utilizing barcode scanning and RFID technology, businesses achieve real-time visibility of stock levels, ensuring reliable and up-to-date inventory data.

- Any manual entry greatly increases the risk of data entry errors, which reduces the accuracy of the inventory records.

- Underperiodic inventory systems, a temporary account, Purchase Returnsand Allowances, is updated.

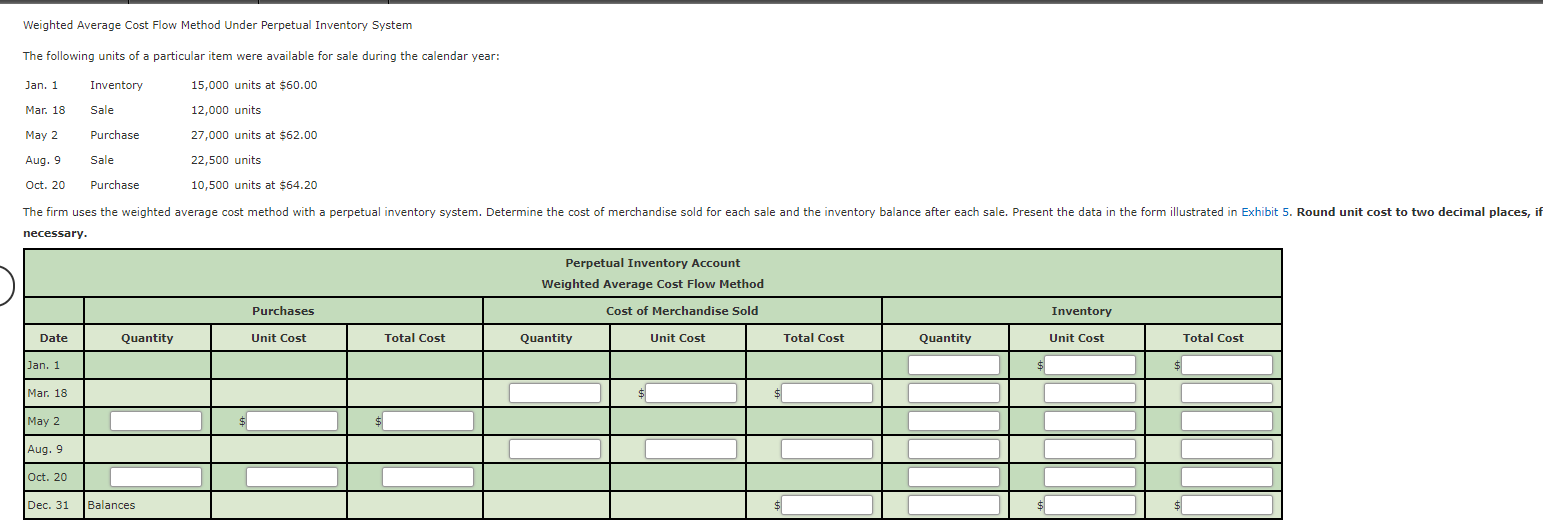

A perpetual inventory system is an inventory management software application that continuously adjusts your inventory based on your transactions rather than a physical inventory count. The system starts with the baseline from a physical count and updates the figure based on purchases received and goods shipped. This card shows the starting inventory, sales, purchases, prices and balances.

How frequently does a physical inventory need to be taken with a perpetual inventory system?

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. By contrast, recording every single transaction as soon as it takes place is tiresome and monotonous for bookkeepers under a perpetual system, and so computers and other devices are used.

What is your current financial priority?

FIFO (first in, first out) refers to an accounting system that assumes the oldest products are sold first, followed by newer ones. LIFO (last in, first out) assumes the most recent products are sold before older ones. Each of these methods has its pros and cons when it comes to use within a perpetual inventory system. Overall, once a perpetual inventory system is in place, it takes less effort than a physical system. Traditionally, the perpetual inventory system was used by companies that buy and sell easily identifiable inventories such as jewellery, clothing and appliances etc. However, advanced computer software packages have made its use easy for almost all business situations and the companies selling any kind of inventory can now benefit from the system.

What Is the Difference Between Perpetual and Periodic Inventory Systems?

As such, they use occasional physical counts to measure their inventory and the cost of goods sold (COGS). A perpetual inventory system helps streamline the reordering process by alerting you when stock levels are low. This enables ecommerce businesses to set reorder points for each product, ensuring that inventory is replenished before running out.

Perpetual inventory methods

These are only required in periodic inventory system to update inventory and cost of goods sold while the perpetual inventory system does not require closing entries for inventory account. Businesses that use the perpetual inventory system employ cycle counting to maintain the accuracy of records. This process counts a portion of the inventory every day and compares the quantity against inventory records. For instance, the financial and accounting departments depend on real-time inventory data. Integrating inventory management with financial systems helps ensure correct tax and regulatory reporting. The perpetual system may be better suited for businesses that have larger, more complex levels of inventory and those with higher sales volumes.

It gives business owners a more accurate picture of the customer preferences. The materials management team can plan how many extra units must be manufactured or purchased from suppliers. The accounting division may now calculate the ending inventory balance for month-end reporting.

A perpetual inventory system centralises your inventory data and tracks your inventory in real time to give you a precise inventory count instantaneously. Perpetual inventory systems begin with a physical inventory count that is then recorded electronically. Periodic systems, while simpler, present challenges in terms of accuracy and timeliness. Without continuous updates, inventory data can become outdated, leading to potential discrepancies and inefficiencies.