Book Value of Assets: What It Is and How to Calculate It

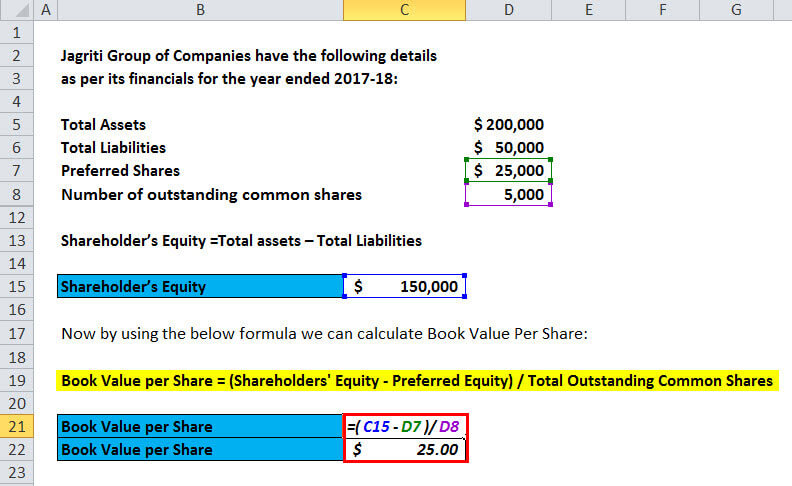

Mathematically, book value is the difference between a company’s total assets and total liabilities. The formula to calculate the net book value (NBV) is the purchase cost of the fixed asset (PP&E) subtracted by its accumulated depreciation to date. Book value can be applied individually to an asset, or it can be broadly applied to an entire company. However, when applying the concept more broadly, the effect of depreciation may not apply to all assets. Additional factors like shareholder equity and debt may also have to be accounted for when assessing the book value of an entire company.

The Difference Between Market Value per Share and Book Value per Share

Market value—also known as market cap—is calculated by multiplying a company’s outstanding shares by its current market price. The Bottom Line Using book value is one way to help establish an opinion on common stock value. Like other approaches, book value examines the equity holders’ portion of the profit pie.

How Does BVPS Differ from Market Value Per Share?

Critics of book value are quick to point out that finding genuine book value plays has become difficult in the heavily-analyzed U.S. stock market. Oddly enough, this has been a constant refrain heard since the 1950s, yet value investors continue to find book value plays. Failing bankruptcy, other investors would ideally see that the book value was worth more than the stock and also buy in, pushing the price up to match the book value. Carrying value or book value is the value of an asset according to the figures shown (carried) in a company’s balance sheet.

What Is Book Value Per Share (BVPS)?

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

This means that, in the worst-case scenario of bankruptcy, the company’s assets will be sold off and the investor will still make a profit. Another way to increase BVPS is for a company to repurchase common stock from shareholders. Assume XYZ repurchases 200,000 shares of stock, and 800,000 shares remain outstanding. Value investors actively seek out companies with their market values below their book valuations. They see it as a sign of undervaluation and hope market perceptions turn out to be incorrect.

Fixed Asset (PP&E) Assumptions

U.S. generally accepted accounting principles (GAAP) require marketing costs to be expensed immediately, reducing the book value per share. However, if advertising efforts enhance the image of a company’s products, the company can charge premium prices and create brand value. Market demand may increase the stock price, which results in a large divergence between the market and book values per share. The book value of a company is equal to its total assets minus its total liabilities. The total assets and total liabilities are on the company’s balance sheet in annual and quarterly reports. Profitable companies typically have market values greater than book values.

- It just means that the asset has no value on the balance sheet—it has already maximized the potential tax benefits to the business.

- Annual additions to accumulated depreciation are intended to reflect an asset’s loss of value over time.

- In some cases, a company will use excess earnings to update equipment rather than pay out dividends or expand operations.

Calculate BVPS for any stocks you own, and you’ll see it can be wildly different from the company’s share price. This is because the share price is a demand-driven value that’s influenced how to turn your ideas into action by the investment community’s opinion on the company’s earnings potential. That said, looking deeper into book value will give you a better understanding of the company.

Assume that XYZ Manufacturing has a common equity balance of $10 million and 1 million shares of common stock are outstanding. This means that the BVPS is ($10 million / 1 million shares), or $10 per share. If XYZ can generate higher profits and use those profits to buy assets or reduce liabilities, the firm’s common equity increases.

A price-to-book ratio under 1.0 typically indicates an undervalued stock, although some value investors may set different thresholds such as less than 3.0. Hence, if an enterprise undergoes liquidation, the fair value prediction of assets clearly indicates that the owners (shareholders) cannot receive the net carrying value of assets. The 2nd part divides the shareholders’ common equity, which is available to the equity shareholders by the unprecedented number of common equity shares. The ratio may not serve as a valid valuation basis when comparing companies from different sectors and industries because companies in other industries may record their assets differently. As a result, a high P/B ratio would not necessarily be a premium valuation, and conversely, a low P/B ratio would not automatically be a discount valuation when comparing companies in different industries.

Comparing the two can help investors determine if a stock is overvalued or undervalued, given its assets, liabilities, and ability to generate income. Like all financial measurements, the real benefits come from recognizing the advantages and limitations of book and market values. The investor must determine when to use the book value, market value, or another tool to analyze a company.