order of liquidity Financial definition

Because they are the most liquid, meaning, you can convert them to cash quickly and easily. Let’s take a look at an example of a balance sheet for a fictional company “ABC Enterprises” to illustrate the order of liquidity. The AI EO addresses everything from advancing AI in healthcare to developing guidance designed to mitigate risks of IP theft. But two of its more consequential provisions — which have raised the ire of some Republicans — pertain to AI’s security risks and real-world safety impacts. High liquidity ensures that firms can make these moves promptly without resorting to lengthy financing processes.

How We Make Money

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. The ordering of the items in a balance sheet (assets and liabilities) is called marshalling. In accounting, the term order of liquidity describes the order of decreasing liquidity in which assets are presented in the balance sheet. Understanding the composition and characteristics of other assets is essential for accurately evaluating an organization’s liquidity position and overall financial health.

Quick Links

Conversely, a wide bid-ask spread signifies low liquidity, as there is a significant gap between the prices at which buyers are willing to purchase and sellers are willing to sell. For example, if a company has cash on hand but also holds patents they can sell, the company may decide to sell the patents in order to raise cash quickly. Finally, intangible assets are at the bottom of the list because they are the least liquid and can take longer to convert to cash. A company’s order of liquidity is an important factor to consider when assessing its financial health. Liquidity isn’t just about survival; it empowers strategic agility, enabling timely capitalization on growth prospects and investment opportunities. Liquid firms can swiftly capitalize on promising investment opportunities without the lengthy process of securing external funds.

What is the Importance of Understanding Order of Liquidity in Financial Analysis?

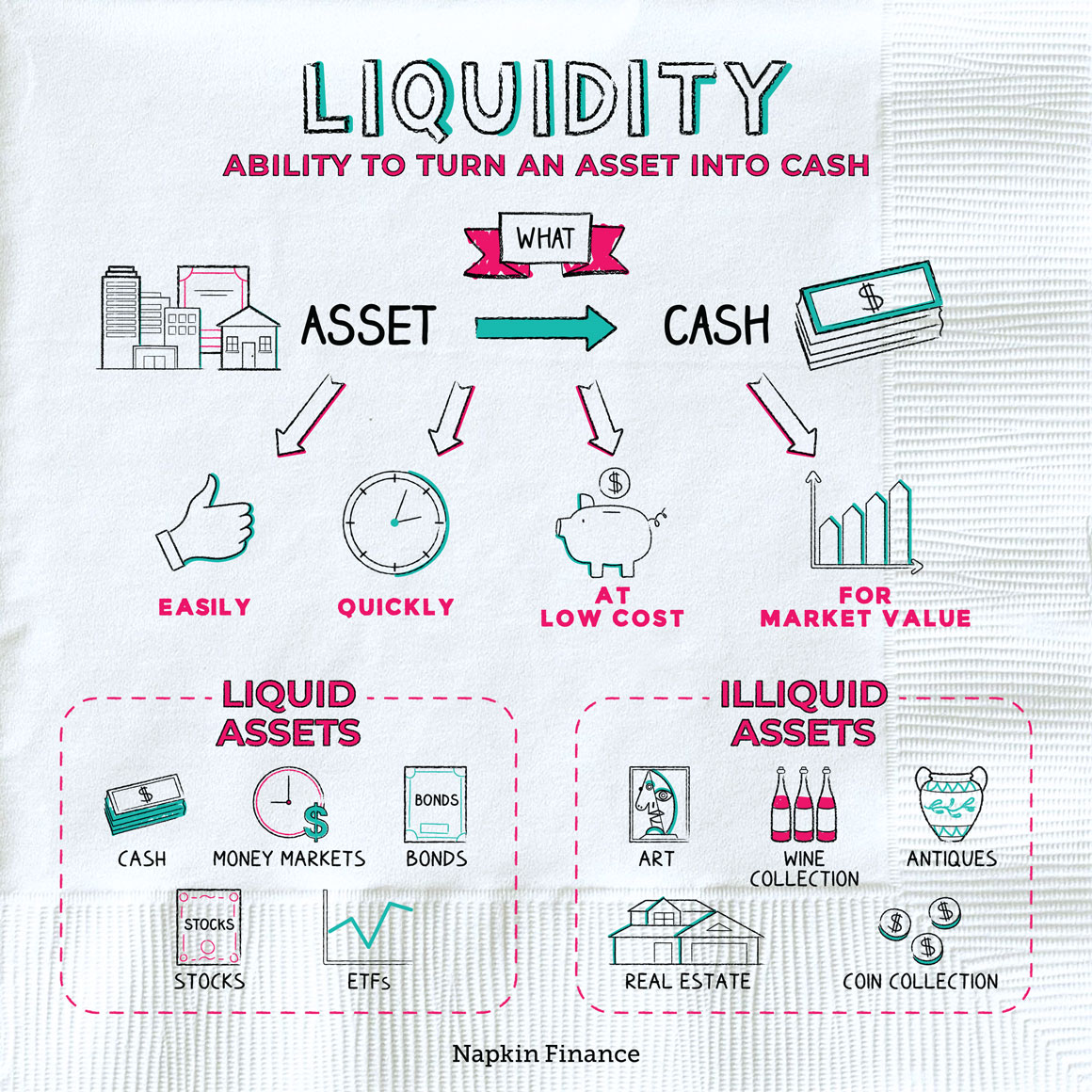

High liquidity is synonymous with a liquid market, where assets can be swiftly bought or sold without causing substantial price movements. On the other hand, low liquidity can lead to price volatility and may result in difficulties in executing trades at favorable prices. Liquidity, in the realm of finance, refers to the degree to which an asset or security can be quickly bought or sold in the market without causing a significant change in its price.

- Incorporating order of liquidity considerations in financial modeling can lead to more accurate forecasting of cash flows and better risk management.

- Led by editor-in-chief, Kimberly Zhang, our editorial staff works hard to make each piece of content is to the highest standards.

- Conversely, a wide bid-ask spread signifies low liquidity, as there is a significant gap between the prices at which buyers are willing to purchase and sellers are willing to sell.

- The first thing that comes to mind is petty cash, which is the money a business puts aside to make small purchases on regular basis and it has someone responsible for this petty cash amount.

- Which are liquid assets you can convert into cash immediately at the current assets of the market price, through marketable securities.

How Can Order of Liquidity Affect a Company’s Financial Health?

Assets with lower liquidity may offer higher returns, but they also carry a higher risk of not being easily sold in the market. As we embrace the multifaceted nature of liquidity and its order, it is imperative for investors, financial analysts, and market participants to integrate these concepts into their decision-making processes. By doing so, individuals can enhance their understanding of liquidity risk, optimize their portfolio composition, and make strategic investment choices that align with their financial goals and risk appetite. Further down the order of liquidity are assets such as real estate, private equity investments, and certain types of bonds that may have limited trading activity or longer settlement periods. These assets are characterized by lower liquidity, as their conversion into cash may entail longer timeframes, transaction complexities, or the need to find suitable buyers or counterparties. There are various factors that contribute to the liquidity of an asset, including the trading volume, bid-ask spread, market depth, and the presence of willing buyers and sellers.

Bankrate logo

While the advantages of liquidity encompass flexibility, risk reduction, and seizing opportunities, potential risks include limited investment options and opportunity costs. This metric offers a more stringent assessment of a company’s short-term liquidity, as inventories may not be as readily convertible to cash as other assets. A financial crisis might be exacerbated when institutions lack funding liquidity, as they might resort to selling assets en masse, further driving down prices and creating a vicious cycle. Operational costs such as payroll, raw material purchases, and utility bills require liquid assets.

For an individual, this could mean owning a house outright but not having the cash to cover utility bills and student loan payments. If your only assets are your house and car — both illiquid assets — you have liquidity risk. For example, if a company needs to carry out a large purchase within 30 days, but most of its assets are tied up in long-term investments, the company would have liquidity risk. Well, marketable securities such as stocks, bonds, ETFs and mutual funds are typically considered liquid because they can often be sold or traded quickly.

Promptly collecting receivables, negotiating favorable payment terms with suppliers, and optimizing inventory levels can free up cash, enhancing liquidity. These tools grant companies the ability to draw funds when needed, enhancing their liquidity position without holding excess cash reserves. This involves diligent monitoring of inflows and outflows, ensuring timely collections, delaying unnecessary expenses, and leveraging technology for cash flow forecasting. Market liquidity refers to liquidity within an entire market, such as the stock market or real estate market. Securities like stocks or other publicly traded financial assets fall somewhere along the middle of the liquidity spectrum.

It permeates the core of financial markets, influencing market integrity, risk management practices, and the overall resilience of the financial system. Liquidity is a fundamental concept in finance, referring to the ease with which an asset can be converted into cash without significantly impacting its market price. In simpler terms, it measures how quickly and efficiently an asset can be bought or sold in the market. Assets with high liquidity can be easily traded, while those with low liquidity may encounter challenges in finding buyers or sellers at a desired price. Aggregated order books function by pulling data from various exchanges and liquidity providers, combining all available buy and sell orders into one unified feed.

Thus, the stock for a large multinational bank will tend to be more liquid than that of a small regional bank. The most liquid stocks tend to be those with a great deal of interest from various market actors and a lot of daily transaction volume. Such stocks will what does order of liquidity mean also attract a larger number of market makers who maintain a tighter two-sided market. In addition to trading volume, other factors such as the width of bid-ask spreads, market depth, and order book data can provide further insight into the liquidity of a stock.

When analyzing financial statements, goodwill considerations are essential as they impact the overall net worth and value of a company. Understanding and assessing goodwill allows investors and stakeholders to gauge the true value of a business beyond its physical assets. In terms of liquidity assessments, goodwill can affect a company’s ability to generate cash flow and meet short-term obligations, making it a critical component in financial decision-making processes.